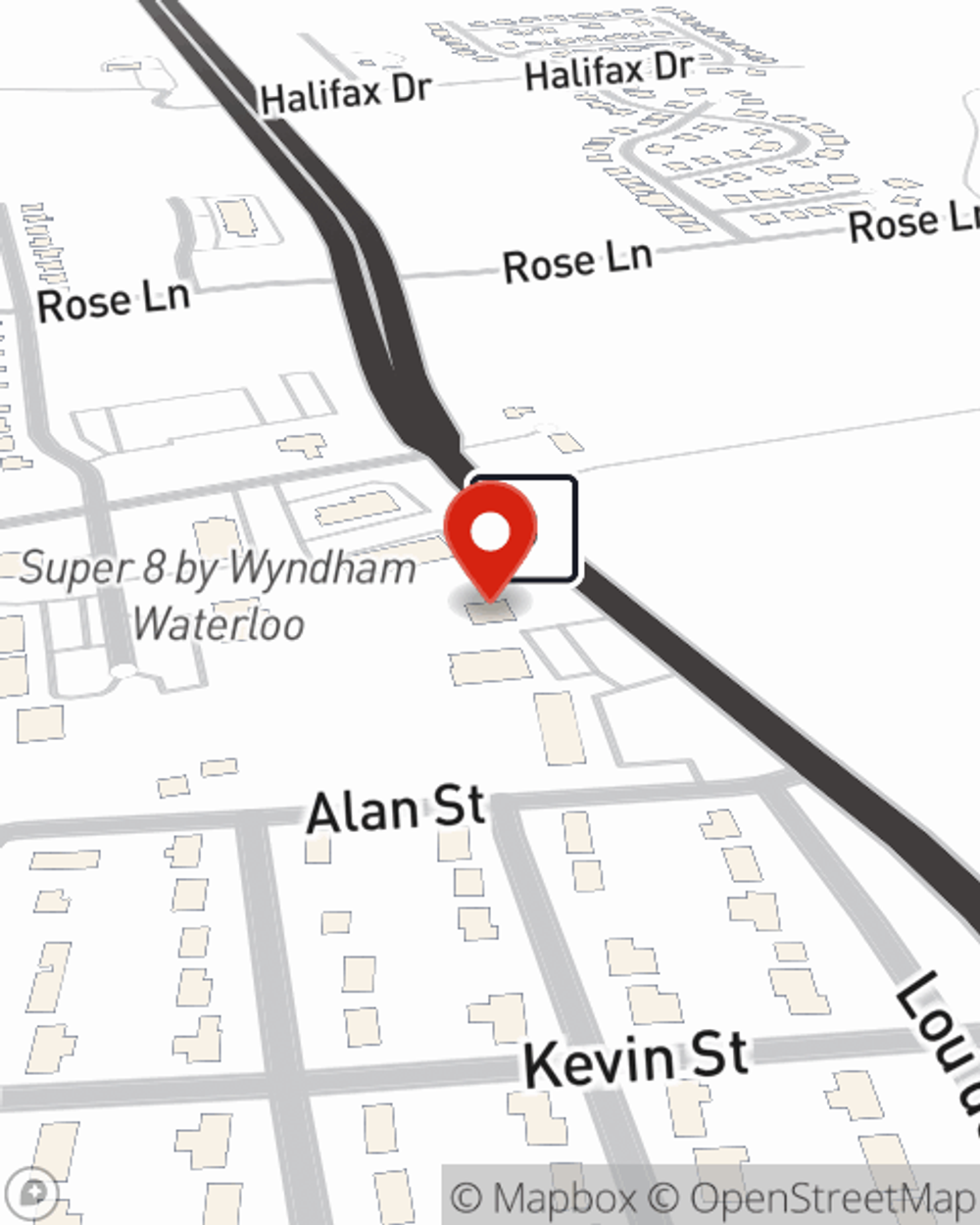

Business Insurance in and around Waterloo

Calling all small business owners of Waterloo!

This small business insurance is not risky

- Waterloo, IL

- Valmeyer, IL

- Columbia, IL

- Monroe County

- Randolph County

- St Clair County

- Clinton County

- Millstadt, IL

- Belleville, IL

- St Louis County

- St Louis Metro Area

- Red Bud, IL

- Freeburg, IL

- Smithton, IL

- Madison County

- Jefferson County

- St Charles County

- Serving IL and MO

- New Athens, IL

Business Insurance At A Great Price!

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide great insurance for your business. Your policy can include options such as a surety or fidelity bond, errors and omissions liability, and extra liability coverage.

Calling all small business owners of Waterloo!

This small business insurance is not risky

Protect Your Future With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Stacy Jackson for a policy that covers your business. Your coverage can include everything from worker's compensation for your employees or errors and omissions liability to group life insurance if there are 5 or more employees or key employee insurance.

Call Stacy Jackson today, and let's get down to business.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Stacy Jackson

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?